When The Bad Times Roll: Importance of Staying Invested During Difficult Times

Rising interest rates, high inflation, recession fears, political stalemates, and war are some of the headlines we have become accustomed to seeing every day over the past two years. With so many such headlines, it can be hard to focus on the long term. While navigating these troubling waters, some may find themselves inadvertently making financial mistakes that can have a serious impact at retirement. One of the more common, and potentially devastating, mistakes is selling your investments to buy GICs or other guaranteed investments when markets are in a downturn. This is why having a financial plan, owning quality securities, and being prepared is so critical to financial success. As your advisor, I want to illustrate how this mistake can impact your future – if you allow your emotions to corrode the framework for investment success.

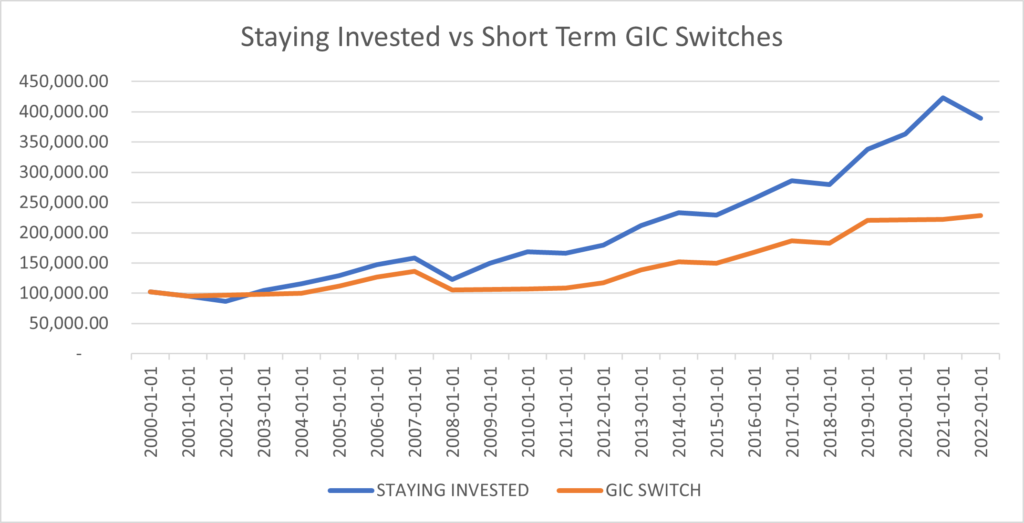

To illustrate the financial impact of selling equity (stock) investments to buy GICs until the market recovers, let’s examine two fictional portfolios of $100,000 starting at 12/31/1999. The first is composed of Canadian equities (35%), US equities (35%), and bonds (30%) – a typical balanced portfolio. The second is identical, except the investor sells all their investments to buy GICs for three years when a major crisis occurs. Since January 2000, there have been three major crises: the DotCom (Tech Wreck) collapse, the 2008 Financial Crisis, and COVID-19. Following each crisis, the market went on to set a new high. Those who stayed invested and followed the investment framework for success, as in our first fictional portfolio, were well rewarded with an average annual return of 6.70% between 01/01/2000 and 12/31/2022. The second portfolio, however, wherein the investor sold their long-term equities when the market took a downturn in 2000/01, 2008, and 2020 and bought GICs for a three-year period, realized a much lower average annual rate of 3.66% – about 50% less! The effect this has on our initial fictional portfolio value of $100,000 is as follows:

The final values of our fictional portfolios are $389,186.52 (blue) and $228,840.29 (orange), and this does not factor in any additional investment since our start date of 12/31/1999. This is a difference of $160,346.23 for our second portfolio. By being scared out of the market, your likelihood of missing substantial gains in a market recovery is significant. By focusing on the short term instead of the long-term objective, and by allowing emotions to corrode the framework, our second investor has reduced their available investments and now must work harder or longer to make up for lost growth. Statistically speaking, the best days in the market occur during a bear market or in the first two months of the new bull market. Over the past 30 years, had you missed the ten best days, your returns would be cut approximately in half.

Working with a team of professionals to build a framework and help contain your emotions is a key component to financial success. You cannot time the market, however, time in the market, owning quality proven investments in the first place and staying invested when times get tough, all prove critical to your financial success.

Written By: Adam Prittie

Sources: StatsCan GIC data; S&P 500 market returns since 2000; TSX market returns since 2000; Bond aggregate index returns since 2000