At Mandeville, our investment approach is based on the concept that since the needs of the affluent and institutional investor are the same as the wealth-seeking investor, the portfolio profiles should be similar.

Yet... The Wealthy Invest Differently

The world's most successful institutions and affluent investors have achieved above average rates of return utilizing an asset mix combining traditional and private and alternative investments. Why? Private Investments are not impacted by market fluctuations which dampens volatility and are a source of diversification that can mitigate overall portfolio risk and are often long-term investments with high growth potential.

The Wealthy Invest Differently. Mandeville's mission is to provide all wealth-seeking investors with ACCESS to investment opportunities both within the public and private realm that are typically reserved for the affluent and institutional investor.

Private Investing and Alternative Investing

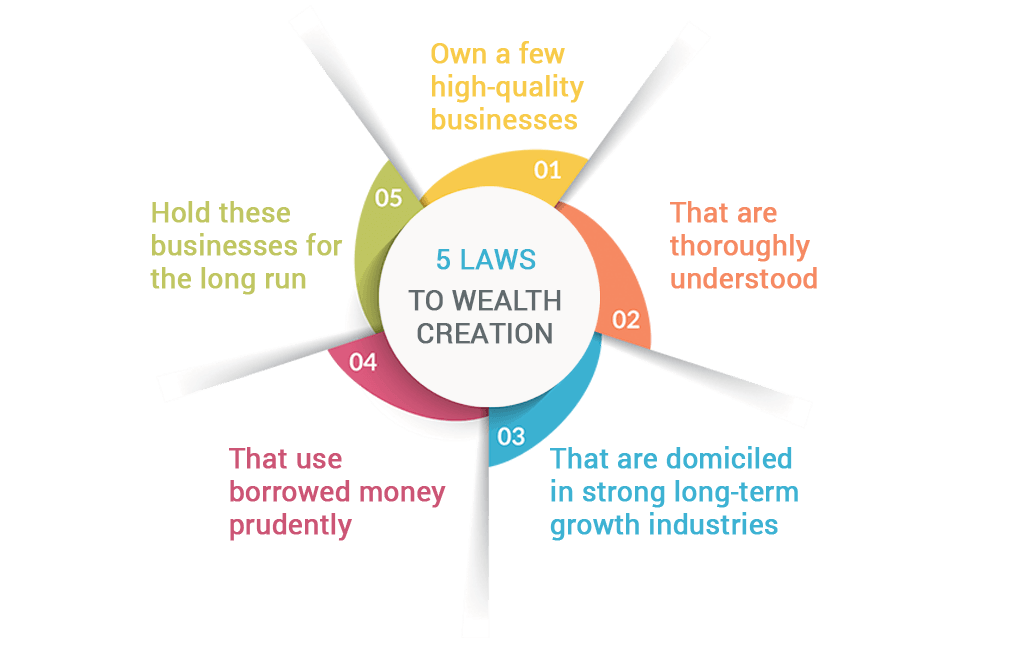

We create and preserve wealth by providing to individuals, institutions and foundations the necessary services and solutions consistent with the worlds' largest and most successful institutional and high net worth investors.

An Institutional Approach to Investing

At Mandeville, our investment approach is based on the concept that since the needs of the high net worth and institutional investor are the same as the average investor, the portfolio profiles should be similar.

To start a conversation, book a discovery meeting with absolutely no obligation by either completing the below form or calling our Client Service Director; Anka Molon at 613-728-0101.

When interest develops and we are approached by an advice-seeking individual, we never ever conduct business at the first meeting. We simply want what you want - the opportunity without any obligation whatsoever to discover fit, function and facts before deciding on any course of action. We value the opportunity to discuss the benefits of working with us and learn about each other - this is simply a win-win.

Consider joining us for a discovery meeting and a second opinion. A meet and greet with an Advisor should be enjoyable and that is what we guarantee!

Come meet us! We provide paid parking and a great cup of coffee!