Why Should You Do Business With Us?

INDEPENDENCE

This means absolutely no ties to any proprietary investments. We always select the best public or private investment solution without any bias whatsoever. What matters is cost vs benefit and best in class solutions for you - as opposed to anyone else.

WE ARE TRANSPARENT

There are never any additional embedded fees or hidden compensation. We are fully transparent. The only costs you ever pay is shown on your monthly statements.

CARE & CONSIDERATION

There is a saying “no one cares what you know until they know that you care”. Never has this been more applicable than in investment management or medical situations. I strongly believe no one will care more about your money/wealth creation and account management (outside of you and your loved one) than us. With decades of experience, we have the client testimonials, references and ongoing advocacy for our services to prove it!

About Prittie Private Wealth

We strive to educate our clients about their financial health and wealth. We have extensive experience in planning, designing and implementing the solutions that will build your financial future.

We are committed to providing enhanced financial solutions to our clients and, as such, are aligned with Mandeville Insurance Services Inc. to offer financial products such as Life Insurance, Disability, Critical Illness and other related wealth protection and risk management products to help clients establish a solid financial foundation for their future.

Financial Advice & Services

based on our guiding principles of wealth - integrity - wisdom

based on our guiding principles of

wealth - integrity - wisdom

Results Based Wealth Management

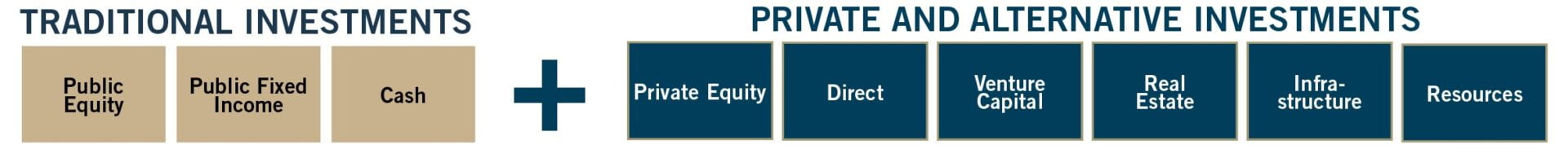

We create and preserve wealth by providing individuals and business owners with tax efficient strategies to prudently grow their financial and life goals. Our philosophy is communicating the benefit of a balanced approach between Public and Private Investing. Wealth is created not only in the public markets but also by private businesses. The world’s most successful institutions and high net worth investors have been investing in this space for generations and have achieved above-average rates of return utilizing an asset mix combining traditional and private and alternative investments.

Get To Know Us

Adam Prittie,

Adam Prittie, CFP®, CIM®, BCOM

Portfolio Manager, Investment Advisor

Adam Prittie is a Portfolio Manager, Chartered Investment Manager (CIM®) and holds his Certified Financial Planner (CFP®) designation with Prittie Private Wealth and Mandeville Private Client Inc. in Ottawa Ontario.

Adam graduated from Carleton University’s Sprott School of Business with a Bachelor of Commerce and a concentration in Finance. At university, Adam excelled by competing at international case competitions with universities from around the globe. He was honoured to be elected as the Vice-President of Finance for the Sprott Accounting Student Association. Adam was a member of Sprott’s JDCC debate team where he became the team lead in competitions across the province. Furthermore, Adam Prittie successfully tied for 2nd place on the FP Canada™ President’s List for the May 2023 CFP® Exam. This list recognizes the top three candidates in Canada for each administration of the CFP exam. Out of 406 candidates; he placed 2nd place which puts him in the top 1%.

He provides enhanced wealth creation solutions to successful and true seekers of financial advice through a principle based and proven processes in an impartial environment. His aim is to ensure you meet your financial goals and to exceed your expectations.

In the office, Adam liaising with clients during account reviews and planning purposes and he conducts extensive investment research and builds portfolio management systems for streamlined investment modelling to help enhance returns. Adam possesses a strong commitment and passion for exceeding client expectations and providing added value in his interactions with clients.

Outside the office, Adam greatly enjoys reading and spending time with his family and friends. He considers himself a history buff, striving to go beyond his own roots to understand the history and culture of others. As Sir Winston Churchill stated; “Those who fail to learn from history are doomed to repeat it.” This statement is important to Adam as history helps us understand how events in the past made things the way they are today. Adam is keen to travel and has been to Europe a number of times to recognize Canada’s contribution and individual soldiers during the first and second world war, including attending the 100th anniversary ceremonies at Vimy Ridge, France.

Core Values

We provide enhanced wealth creation solutions to successful and genuine seekers of financial advice. We offer principled and proven processes in an impartial professional environment. Our aim is to ensure you meet your financial goals and to exceed your expectations.

We have developed many long-term relationships with individuals who have sought their advice and utilized their knowledge and experience. “We have succeeded in implementing and maintaining a personal road map to wealth creation. References are available and encouraged.”

Non-Negotiable Core Values:

Our Process

We create and preserve wealth by providing to individuals, institutions and foundations the necessary services and proven solutions consistent with the worlds’ largest and most successful institutional and high net worth investors.

An Institutional Approach to Investing

At Prittie Private Wealth, our investment approach is based on the concept that since the needs of the high net worth and institutional investor are the same as the average investor, the portfolio profiles should be similar.

Institutional/HNW Asset Allocation Wealth is created not only in the public markets, but also by private businesses.

The largest and most successful institutions in the world like the Canada Pension Plan (CPP) which manages over $183 Billion for the benefit of every Canadian has altered their asset mix in recent years to include private/alternative investments. The Canadian Exempt (private) Market raised $142.91 billion in capital in 2011 alone.

The world’s most successful institutions and high net worth investors have been investing in this space for generations and have achieved uncorrelated above average rates of return utilizing an asset mix combining traditional public as well as private and alternative investment solutions.

The investment objectives of successful, large institutions and those of high net-worth investors are as follows:

Is your objective not the same? If so, why aren’t your portfolios the same?

To help bridge the gap in this apparent dysfunctionality, we offer a very wide array of investment solutions including:

If appropriate for your portfolio, given your objectives, time horizon and liquidity needs, you may want to consider investing in a similar manner.

Our Strength

Our partnership with Mandeville Private Client Inc. and our local branch Capital Wealth Partners was founded to offer a full-suite of financial advice and services:

We believe that our values: “Wealth – Integrity – Wisdom” are what sets us apart.

Our strength with our partners has opened our clients to a full suite of financial advice and services – Financial and Investment Planning; Retirement Planning; Estate Planning and In-House Tax Services.

We are committed to providing enhanced financial solutions to our clients and, as such, are aligned with Mandeville Insurance Services Inc. to offer financial products such as Life Insurance, Disability, Critical Illness and other related wealth protection and risk management products to help clients establish a solid financial foundation for their future.

We are registered and professional Portfolio Managers, experienced in planning, designing and implementing the solutions that will build your financial future. For further information on our branch; Capital Wealth Partners, please click here and to learn more about Mandeville Private Client Inc. click here.

We offer a multi-disciplined approach to preserving wealth. Communicating the benefit of a balanced approach between Public and Private Investing?

Wealth is created not only in the public markets but also by private businesses. The world’s most successful institutions and high net worth investors have been investing in this space for generations and have achieved above-average rates of return utilizing an asset mix combining traditional and private and alternative investments.

Many of the largest and most successful pension plans in the world, i.e. the Harvard Endowment, OMERS, HOOP, the Canada Pension Plan (CPP) have long held private and alternative investments as an important value-added component to their investment strategy.

Despite having the same goals, the Wealthy Invest Differently. At Prittie Private Wealth, our investment approach is based on the concept that since the needs of the wealthy and institutional investor are the same as the wealth-seeking investor, it follows that their portfolios should be similar. We uniquely offer our clients access to world-class proven co-investment and stand-alone private investment opportunities.

The world’s most successful institutions and affluent investors have achieved above average rates of return utilizing an asset mix combining traditional and private and alternative investments. Private investments have many advantages; they are not impacted by market fluctuations which can reduce volatility. They provide an additional source of diversification that can mitigate overall portfolio risk. Many are income-oriented and have very attractive yields for income seekers. Many are often long-term investments with high tax-deferred growth potential.

Democratizing Private Opportunities

Our mission is to provide all wealth-seeking investors with access to investment opportunities both within the public and private realm that are typically reserved for the wealthy and institutional investor. Through Mandeville Private Client Inc., and its parent company Portland Investment Counsel Inc., our clients have access to world leaders in private partnerships, such as the European Investment Bank, Liberty Media, Cygnus/KKR, and many other proven and successful private investors. When working with us, we as registered portfolio managers, provide you instant access to these types of investments without having to meet the accredited investor status (proven net worth/income levels).

Our Mission Statement

Our mission is to preserve and build clients’ wealth by providing proven and effective wealth creation services and solutions to individuals, institutions and foundations in a manner that is consistent with the world’s largest and most successful institutional and high net worth investors. To invest our own money alongside yours in the same manner and in the same investment solutions. To always position our clients’ interest ahead of the firms and our own.

Seminars & Events

Turning Your Savings into Retirement Income: A Clear Plan for the Years Ahead

Join us for a our evening seminar on Wednesday, March 25, 2026 where we discuss turning your savings into reliable retirement income. Learn how to build a clear, tax-efficient plan for the years ahead and make the transition from saving to drawing income with greater confidence.Q