Prittie Private Wealth’s Financial Wealth Empowerment Series

We designed this program for individuals who are ready to take greater control of their financial journey—whether you are just beginning or looking to deepen your understanding of investing. 📈💼

At Prittie Private Wealth, we recognize the value of building strong financial knowledge at every stage. That is why we created a series that simplifies the investing process, provides clear and practical guidance, and helps foster lasting financial habits. 📚💡

Whether you are starting from the ground up or seeking to refine your approach, this program offers the tools you need to make informed, confident decisions—today and into the future. 🚀🔐

Curious about how to take control of your money and future?

Curious about how to take control of your money and future?

When you sign up for our newsletter, you'll get exclusive access to:

Start building your wealth with strategies that work for you.

Fast Facts & Snapshots

Hover over the i next to each number to learn more.

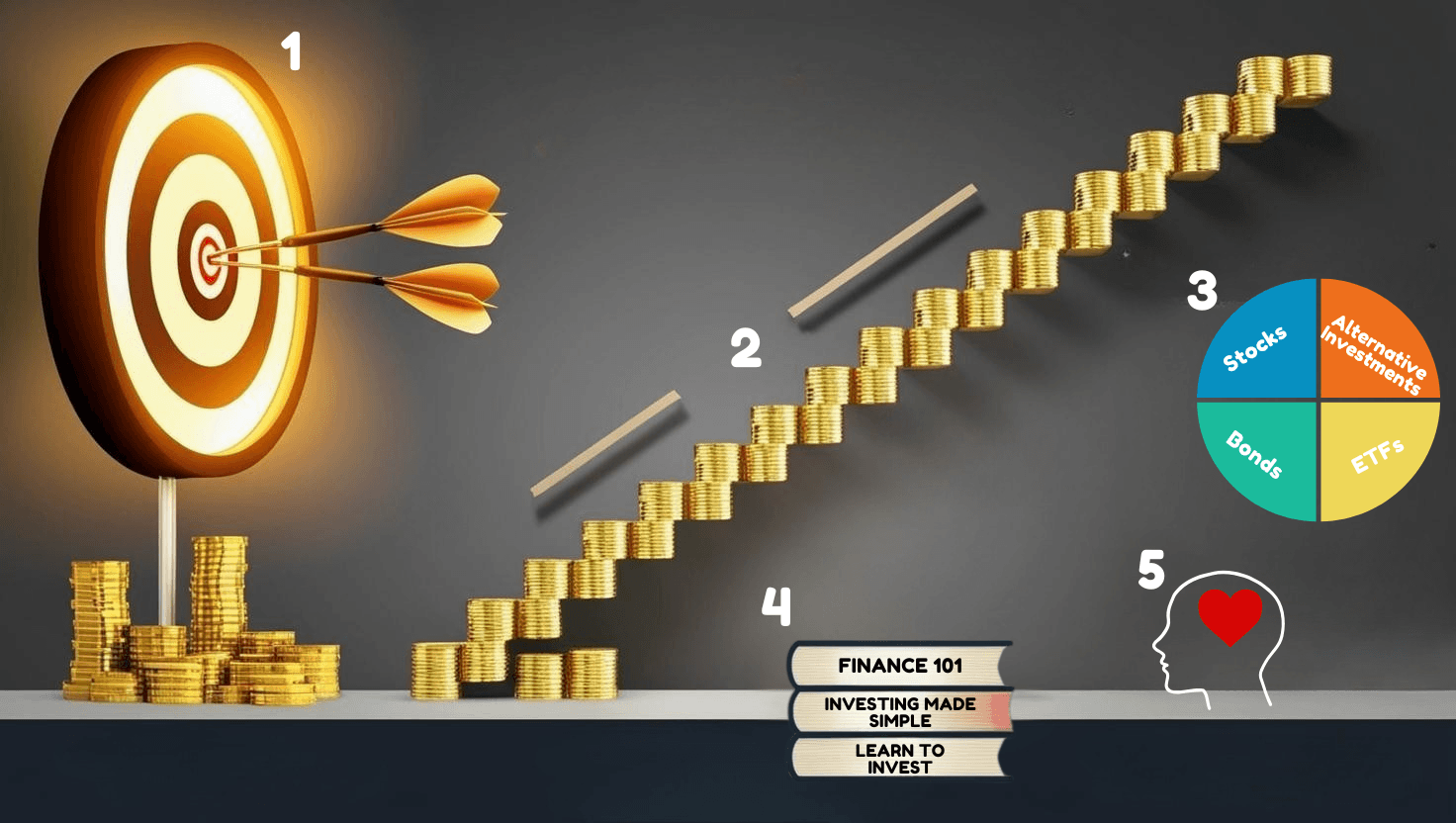

Set Clear Goals

2nStart Small, Stay Consistent

3nDiversify Your Portfolio

4nLearn & Stay Informed

5nAvoid Emotional Decisions

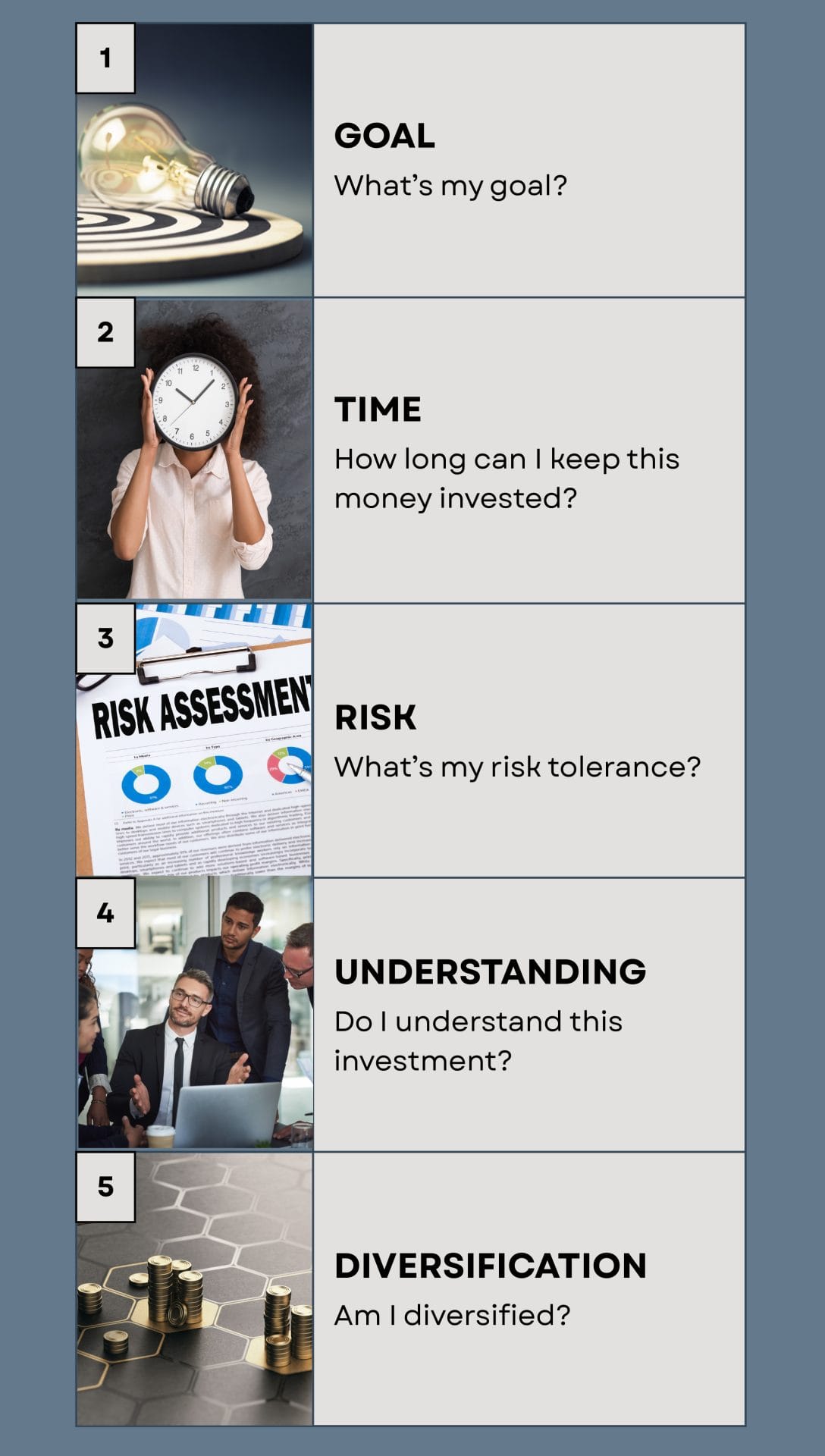

5 Questions To Ask Before You Invest: Investment Checklist

Essential questions for informed investing decisions.

Hover over the i next to each number to learn more.

🎯 1. What’s My Goal?

What it means:

Why are you investing your money? Is it for retirement, buying a house, college, or just to grow your money over time?

Why it matters:

Your reason for investing helps decide what kind of investments you should choose. If your goal is far away (like retirement in 40 years), you can take more risk. But if your goal is soon (like a vacation in 2 years), you should play it safer.

🔹 Example:

If you’re 20 and saving for retirement at 65, you’ve got time—so you can take more risks with your investments. But if you're saving for a car in 2 years, safer options are better.

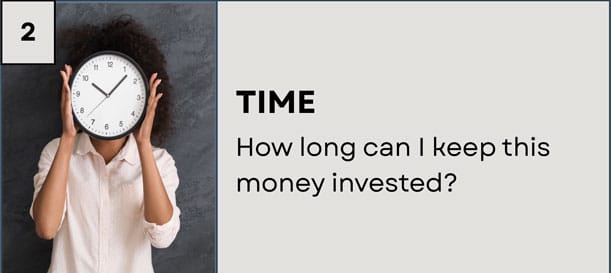

⏳ 2. How Long Can I Leave My Money Invested?

What it means:

This is about how much time you can let your money grow before you need it back. Is it just a few years, or a really long time?

Why it matters:

The more time you have, the more risk you can take, because your money has time to recover if the market goes up and down.

🔹 Example:

If you’re saving for something way down the road—like retirement—you can take more risks with things like stocks, since you have decades to let it grow.

⚖️ 3. What’s My Risk Tolerance?

What it means:

How okay are you with your money going up and down in the short term?

Why it matters:

Some people can handle ups and downs and still sleep at night. Others get really worried if they see their money drop. Knowing your comfort level helps you pick the right investments—and stay calm when things get rocky.

🔹 Example:

If you panic and sell every time the market dips, you might want to stick with lower-risk stuff like bonds or balanced funds.

🧠 4. Do I Understand This Investment?

What it means:

Do you know how the investment works, how it makes money, and what could go wrong?

Why it matters:

If you don’t understand it, you’re more likely to make mistakes—or fall for hype.

🔹 Example:

Thinking about buying a trendy tech stock? Make sure you understand what the company does and how it’s doing financially—not just because it’s blowing up on TikTok.

🧺 5. Am I Diversified?

What it means:

Is your money spread out across different things, or all in one place?

Why it matters:

If one investment tanks, you don’t want your whole account to crash. Spreading your money out (called diversification) lowers your risk.

🔹 Example:

Don’t put all your cash into one stock. Mix it up with index funds, bonds, and even some international options for balance

🎯 1. What’s My Goal?

What it means:

Why are you investing your money? Is it for retirement, buying a house, college, or just to grow your money over time?

Why it matters:

Your reason for investing helps decide what kind of investments you should choose. If your goal is far away (like retirement in 40 years), you can take more risk. But if your goal is soon (like a vacation in 2 years), you should play it safer.

🔹 Example:

If you’re 20 and saving for retirement at 65, you’ve got time—so you can take more risks with your investments. But if you're saving for a car in 2 years, safer options are better.

⏳ 2. How Long Can I Leave My Money Invested?

What it means:

This is about how much time you can let your money grow before you need it back. Is it just a few years, or a really long time?

Why it matters:

The more time you have, the more risk you can take, because your money has time to recover if the market goes up and down.

🔹 Example:

If you’re saving for something way down the road—like retirement—you can take more risks with things like stocks, since you have decades to let it grow.

⚖️ 3. What’s My Risk Tolerance?

What it means:

How okay are you with your money going up and down in the short term?

Why it matters:

Some people can handle ups and downs and still sleep at night. Others get really worried if they see their money drop. Knowing your comfort level helps you pick the right investments—and stay calm when things get rocky.

🔹 Example:

If you panic and sell every time the market dips, you might want to stick with lower-risk stuff like bonds or balanced funds.

🧠 4. Do I Understand This Investment?

What it means:

Do you know how the investment works, how it makes money, and what could go wrong?

Why it matters:

If you don’t understand it, you’re more likely to make mistakes—or fall for hype.

🔹 Example:

Thinking about buying a trendy tech stock? Make sure you understand what the company does and how it’s doing financially—not just because it’s blowing up on TikTok.

🧺 5. Am I Diversified?

What it means:

Is your money spread out across different things, or all in one place?

Why it matters:

If one investment tanks, you don’t want your whole account to crash. Spreading your money out (called diversification) lowers your risk.

🔹 Example:

Don’t put all your cash into one stock. Mix it up with index funds, bonds, and even some international options for balance.

The Power of Compound Interest

Find, the info icon in the graph below to learn more!

📈 Growth Over Time

Compound interest grows your investments by earning interest on both your original principal and on previously earned interest. This applies whether your money is in a savings account, GIC (Guaranteed Investment Certificate), retirement savings plan, tax-advantaged account, or other registered/unregistered accounts.

2⏳ Early Investment Advantage

- Investors benefit from starting early because:

- Tax-advantaged accounts let your investments compound without annual taxes on the growth.

- The earlier you start, the more compounding can work in your favour, especially since contributions can be made yearly to registered accounts.

Small amounts invested early can grow substantially over decades.

3🔄 Frequency of Compounding

Banks and investment products vary in how they apply compounding:

- Savings accounts and GICs often compound interest monthly or annually.

- Market investments (stocks, ETFs, mutual funds) don’t “compound” in the same mechanical way, but reinvested dividends and reinvested gains create the same compounding effect over time.

- More frequent compounding (daily vs. annual) typically means slightly higher returns, though over the long term, the rate of return matters more than the compounding frequency.

⏱ Doubling Time (Rule of 72)

The Rule of 72 works universally: divide 72 by your annual rate of return to estimate how many years it takes to double your money.

Example: An investor earning 6% annually in a balanced portfolio could expect their money to double in about 12 years (72 ÷ 6 = 12).

See Our Latest Videos

Or click the small circles below video to see past videos

See Our Latest Videos

Or swipe left to see past videos

Past Event:

Smart Money Moves for Teens & Young Adults

Press play and watch our last seminar:

What You Will Learn:

- Fundamentals of budgeting and saving

- The power of compound interest

- Introduction to investing: stocks, bonds, and mutual funds

- Credit awareness and responsible spending

- Setting financial goals and making informed decisions

Why This Matters:

Financial literacy is among the most valuable gifts we can provide to the next generation. By introducing essential financial principles early, young people are empowered to make thoughtful choices, avoid common missteps, and lay the groundwork for a successful financial future.

Ready to take control of your financial future?

Stay up to date as new content is released.

Join the Empowerment Series Newsletter—designed to equip investors at every stage with the insights, tools, and strategies to build real wealth with confidence.

You’re always in control. Update your preferences or unsubscribe anytime.