I Thought Bonds Were Safe and Stable?

A common misconception amongst investors is that investments in bonds cannot decline. After all, you receive a certain, pre-determined amount at maturity and you get paid a coupon (interest) each year for a pre-determined amount, right? While this is true, there is a massive caveat to this: You need to hold the bond until maturity and never sell for this to occur, as between purchase and maturity, the price of the bond will fluctuate to some degree based on interest rate movements – Meaning: the “flight to safety” during tough economic times may not return the expected outcome if you intend to trade the bonds before maturity.

Consider the differences between stocks and bonds. A stock provides ownership in a business and when you own stocks, you anticipate that the value will increase over time and you will sell for more than you paid, and perhaps you may collect some dividends along the way as a bonus. Bonds, on the other hand, are no more than a loan from investors to a company or government for a set period of time with terms and conditions of re-payment being pre-defined. When you buy a bond, you are not seeking to grow your capital, but rather you are seeking two things:

- Receive an agreed upon dollar value in the form of interest at regular intervals (coupon)

- Have the “par/face value” original amount returned to you at the end of a pre-determined period

Bonds can be bought in one of three positions: premium, par, or discount. Par means the price is equal to what would be returned to you at the end of the loan period (often denominated in $1,000 increments). A bond trading at a premium means it is selling for more than par and discount for less than par value. When interest rates change, as we have seen over the past couple months, the direction of rates has a direct and opposite effect on bond prices. Bond prices are inverse to interest rate changes, and the reason for this is as follows: If rates rise, this generally means new bond issues will offer a higher coupon (interest rates) than existing bonds, while prices of existing bonds with lower coupon rates fall to keep their yields competitive in the secondary market. The opposite is true when rates fall as new bonds will be issued at lower rates, and the prices for existing bonds with higher coupons will rise as they become more valuable to investors. This relationship between bonds and interest rates has a big impact on those trading bonds as it can provide them with opportunities to buy “discounted” bonds and receive a larger sum at maturity, or those seeking to buy premium bonds, take a slight loss at maturity but receive more in interest.

However, if you are seeking to buy a fixed coupon bond of any term length and hold it to maturity, the implications of interest rate changes means less than you might think. The terms and conditions of bonds don’t change with yields, so even if the price rises or falls, you still receive the same coupon payments and so long as you hold the bond until maturity, your capital will be returned to you as promised by the issuer. This means that the day-to-day price movement does not impact your final profit unless you intend to regularly trade your fixed income securities. Thus, investment grade bonds are inherently “safe” and provide regular fixed income and greater stability than stocks, but are not linear in price.

To illustrate how interest rate changes affect prices, we are now going to look at an example together. The safest bonds are government bonds which are free from default as they are backed by the governments ability to tax its citizens. There is zero credit risk on a government of Canada bond unlike lesser quality (high yield) bonds, but they are still affected by a concept called modified duration which is the calculation that determines how much a bond’s price changes given a 1.00% (100 basis points) change in interest rates.

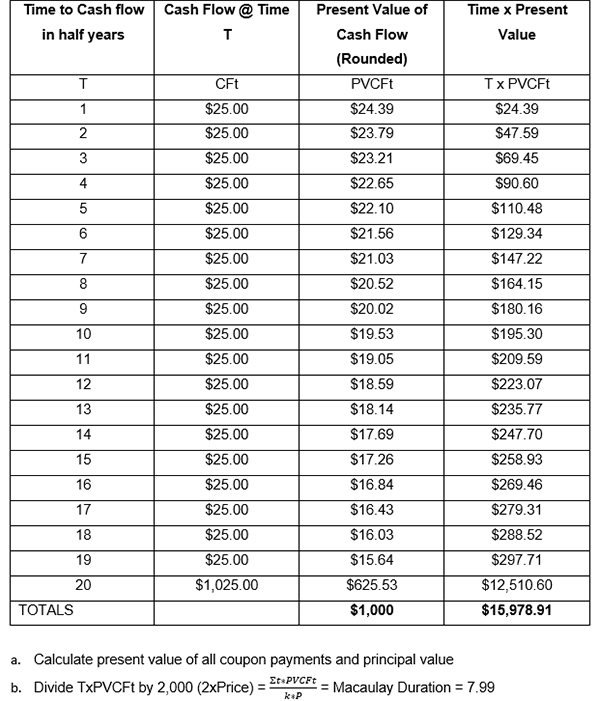

Calculating Price Change for a hypothetical 10-Year 5.00% Semi-Annual Coupon Bond trading @ Par

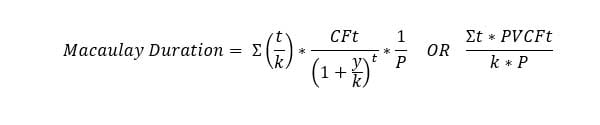

STEP 1: Macaulay duration is the weighted average number of years an investor must maintain the bond for the present value of the bond’s cash flows to equal the amount paid for the bond.

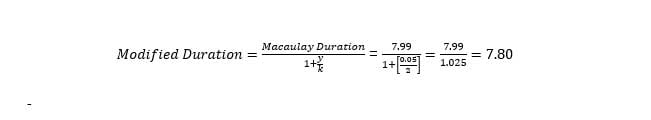

STEP 2: Convert Macaulay Duartion to Modified duarion

Therefore using our 10 year government of Canada bond means:

- Every 1% increase in interest rates, the bond price (face value) would fall approximately 7.80%

- Every 1% decrease in interest rates, the bond price (face value) would rise approximately 7.80%

Written by Adam Prittie